Credit ratings are forward-looking opinions about the ability and willingness of debt issuers, like corporations or governments, to meet their financial obligations on time and in full. They provide a common and transparent global language for investors and other market participants, corporations and governments, and are one of many inputs they can consider as part of their decision-making processes.

Introduction to Credit Ratings

Guide to Credit Rating Essentials

Top 10 Investor Questions On Our Ratings Process

Credit Markets Research

Key Facts About Ratings

Independence and Integrity

S&P Global Ratings is committed to providing transparency to the market through high-quality independent opinions on creditworthiness. Safeguarding the quality, independence and integrity of our ratings, including by identifying and managing potential conflicts of interest, is embedded in our culture and at the core of everything we do.

See How We've Evolved >

Read our Rating Policies >

Read our Code of Conduct >

Learn How We Set the Bar with Our Code of Business Ethics >

Ratings are made publicly available and scrutinized by all parts of the market.

Clear separation between commercial and analytical functions.

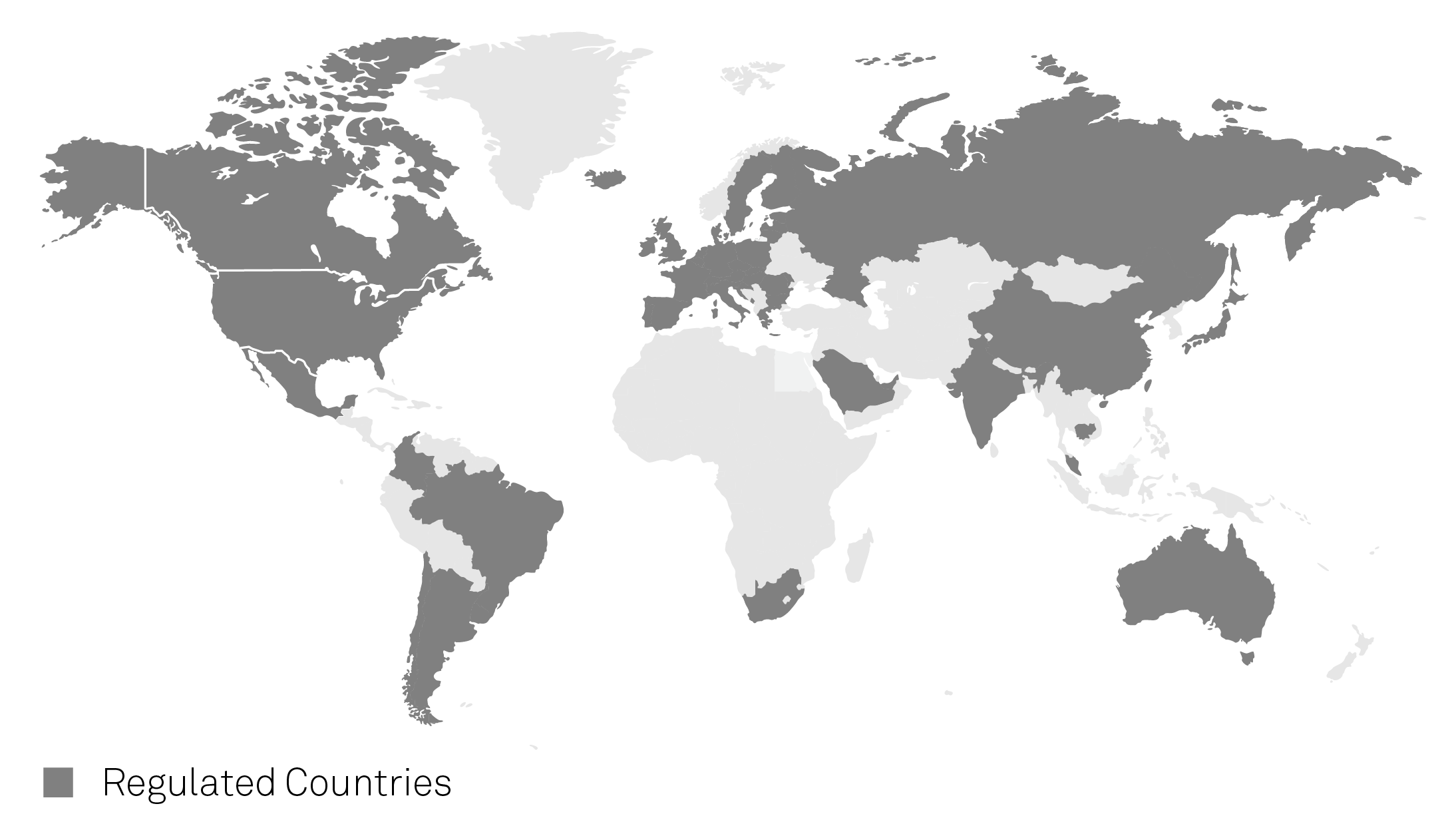

Heavily regulated in more than 20 jurisdictions globally.

Ratings are assigned by committees, not individuals, in application of published methodologies.

We have a strong culture of compliance and risk awareness.

Global Regulation

We have been subject to regulatory oversight for over a decade. We are currently overseen by more than 20 regulators around the globe.

Key Regulatory Milestones (US and EU)

Prior to 2006

Minimal global regulation of Credit Rating Agencies

September 2006

Credit Rating Agency Reform Act signed into law in U.S.

December 2009

EU Regulation 1060/2009 on Credit Rating Agencies (CRA-1) effective in the EU.

July 2010

Dodd-Frank Act passed into law in U.S.

January 2011

ESMA established to supervise CRAs in the EU

June 2011

CRA-2 amendments to the EU CRA Regulation

June 2013

CRA-3 amendments to the EU CRA Regulation

June 2015

New Dodd-Frank rules become effective

Quality and Transparency

The quality, integrity and transparency of our ratings are at the heart of what we do.

Our credit ratings are designed to provide relative rankings of creditworthiness. They are assigned based on transparent methodologies available free of charge on our website. These methodologies are calibrated using stress scenarios (see Understanding Ratings Definitions and Ratings Definitions) and Credit Stability Criteria designed to promote rating comparability across different sectors and over time. They are subject to a rigorous independent validation process.

Credit ratings are assigned by committees composed of analysts, experts in each asset class, which consider a broad range of financial and business attributes, along with other factors, such as competitive position, business risk profile and the current economic environment, in application of the relevant methodologies.

As part of ratings surveillance, we continuously analyze real-time and historical data. If we see events taking place that impact our view on an issuer’s relative creditworthiness, we adjust our ratings accordingly to communicate our views so the market has the correct perception of how we view relative creditworthiness. It is because our ratings evolve over time to reflect changes to market or issuer specific credit drivers that they are seen to have value as one of several factors market participants may consider when assessing credit risk.

We publish default and transition studies annually that show the performance of our ratings over time.

Click here to read S&P Global Ratings' written statement regarding the July 21, 2021 hearing on Bond Rating Agencies: Examining the “Nationally Recognized” Statistical Rating Organizations before the House Financial Services Subcommittee on Investor Protection, Entrepreneurship and Capital Markets.

The mission of S&P Global Ratings is to provide high-quality, objective, independent, and rigorous analytical information to the marketplace.

Emerging Topics

As an independent third-party provider of opinions on creditworthiness, we continuously analyze available financial information, credit trends and other factors such as whether entities have access to capital and liquidity in the current environment. As part of our ongoing ratings surveillance we identify and analyze emerging capital market and credit trends.