Centralized, auditable platform with due diligence for Japanese risk retention transactions, enabling smooth execution of deal information communication.

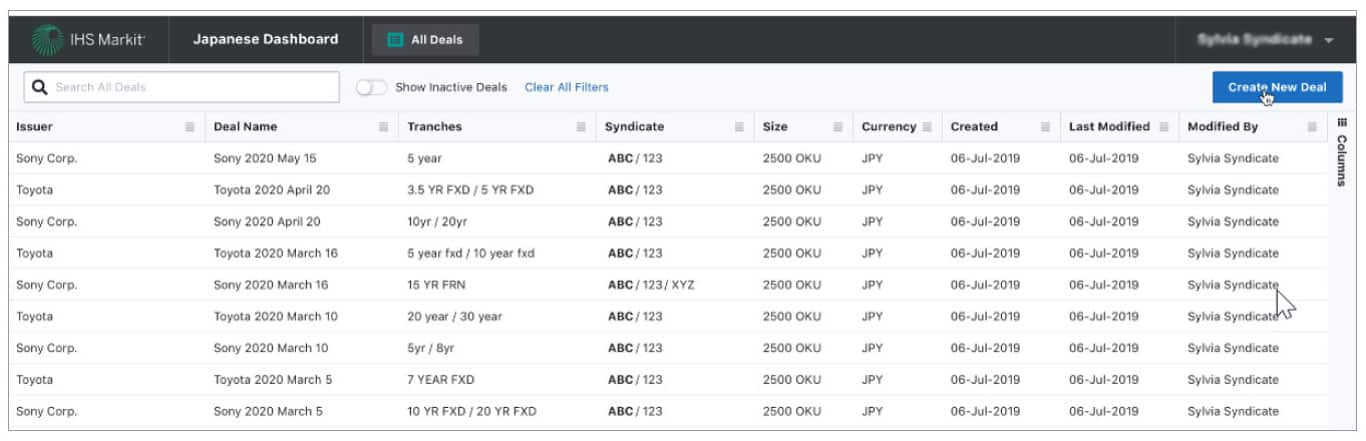

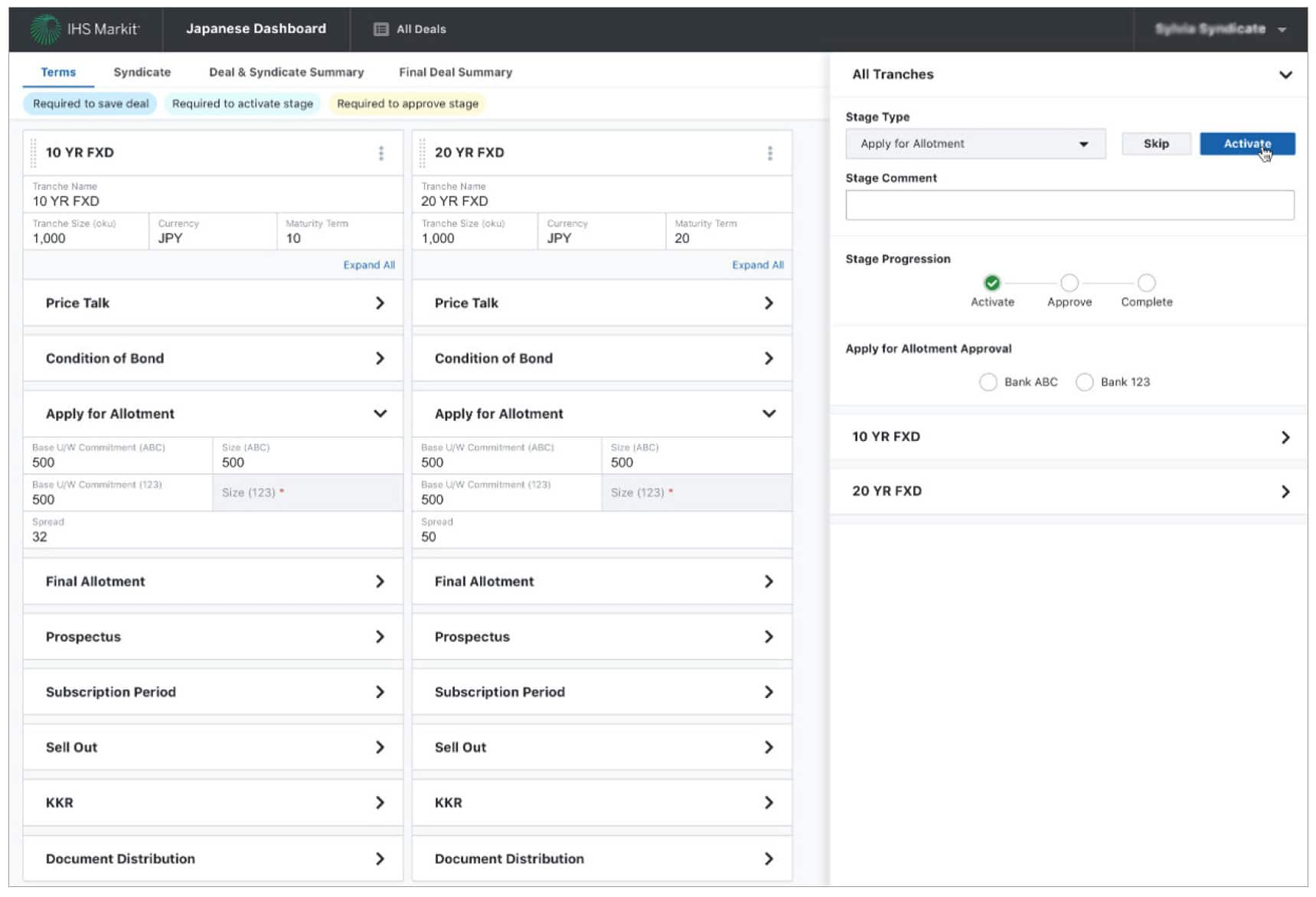

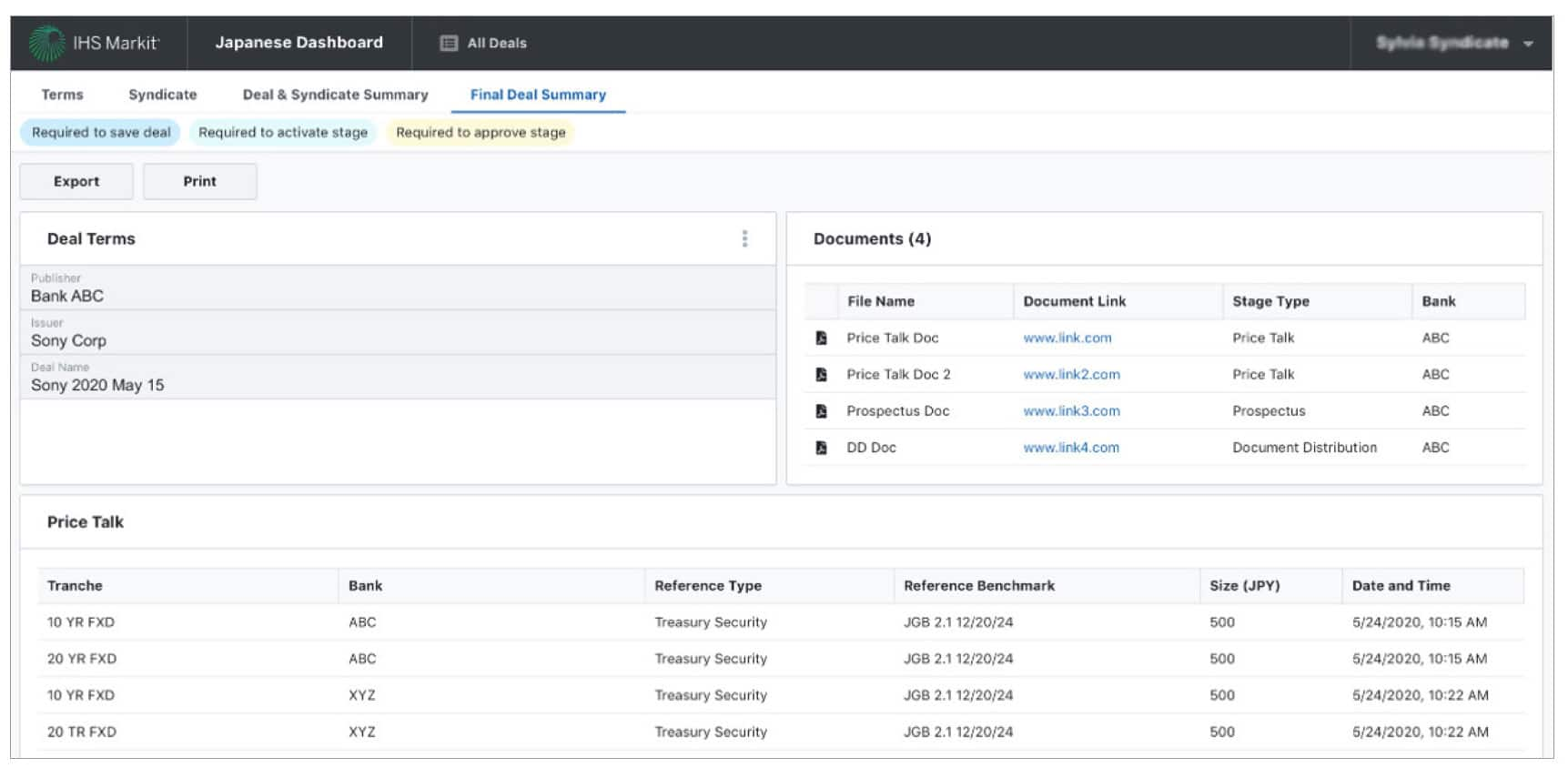

After pricing, the retention market in Japan necessitates coordination of unique deal details between syndication. Japanese Dashboard 2.0 is a rebirth of our original platform, providing banks with the power and ease of use they need while allowing them to execute transactions at their own pace. It consists of multiple stages that must be approved by all underwriters, with a leading bank in charge of all details. Japanese Dashboard 2.0 is a communication enhancement platform that assists a leading bank and all underwriters in completing retention deals in a hassle-free manner. It gives participant banks the ability to communicate deal information, upload documents, monitor the completion of multiple stages that have been accepted between a leading bank and all underwriters with a time stamp, producing an entire summary for an audit trail.